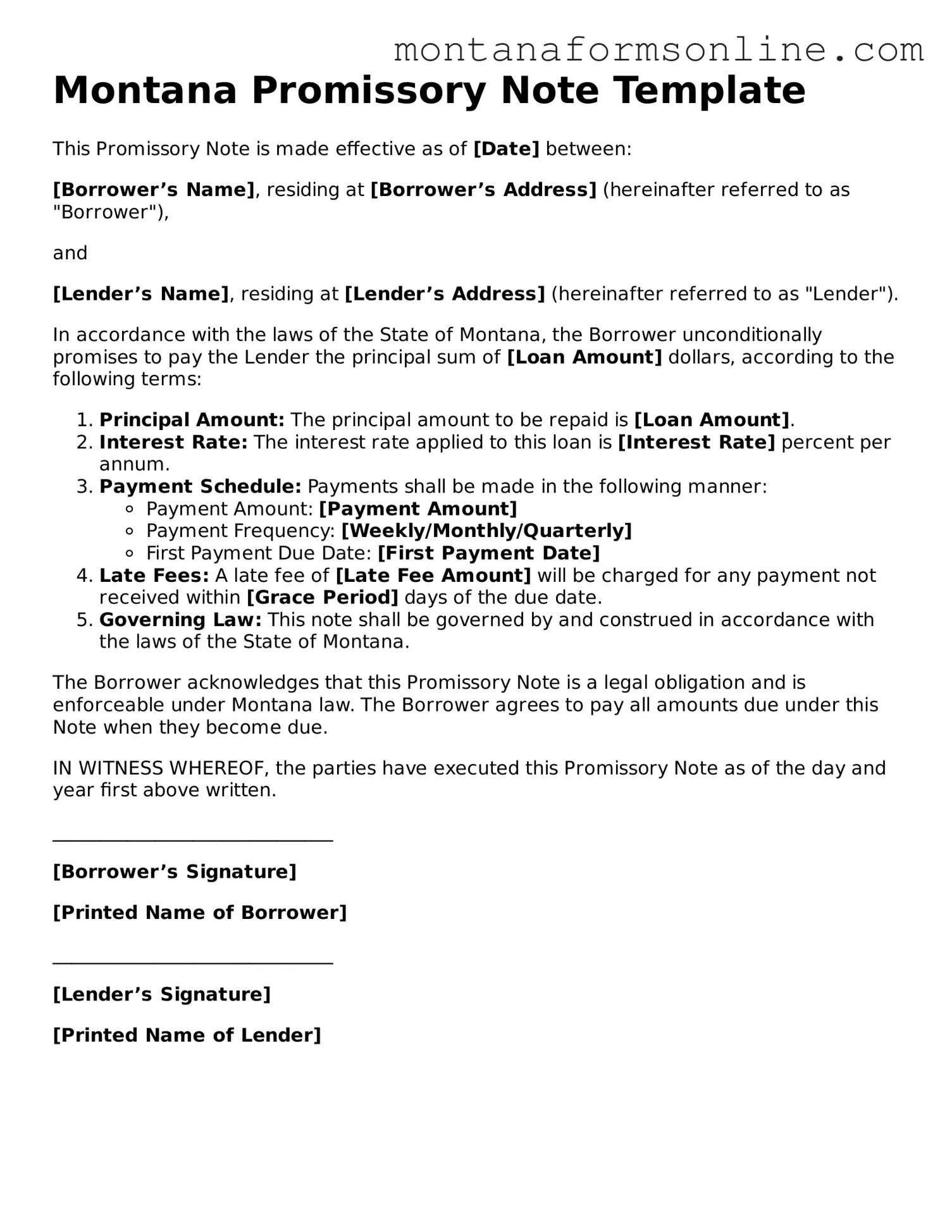

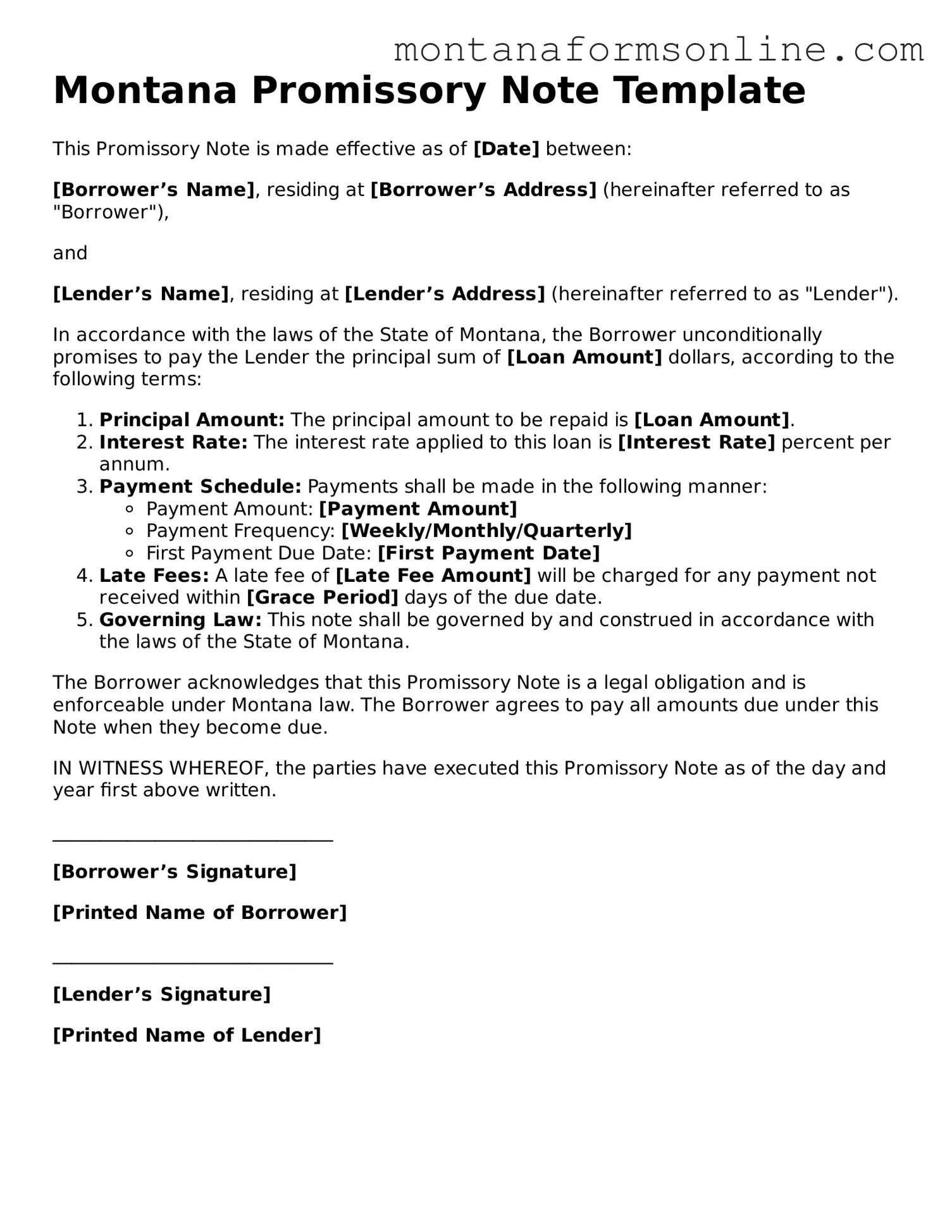

The Montana Promissory Note form shares similarities with the standard Promissory Note, which is a written promise to pay a specified amount of money to a designated person or entity. Both documents outline the borrower’s commitment to repay the loan, including the principal amount, interest rate, and repayment schedule. Additionally, both forms typically include provisions for default, allowing the lender to take specific actions if the borrower fails to meet their obligations. The fundamental structure and purpose remain consistent across various jurisdictions, ensuring that the borrower is legally bound to repay the borrowed funds.

Another document akin to the Montana Promissory Note is the Secured Promissory Note. This type of note not only includes the promise to repay but also specifies collateral that secures the loan. In the event of default, the lender has the right to seize the collateral to recover the owed amount. Like the Montana form, the Secured Promissory Note provides clarity on the terms of repayment, but it adds an extra layer of protection for the lender through the inclusion of collateral, making it a more secure option for lending.

The Loan Agreement is also comparable to the Montana Promissory Note. While a Promissory Note focuses primarily on the borrower's promise to repay, a Loan Agreement encompasses broader terms and conditions governing the entire loan transaction. This document may include details about the purpose of the loan, fees, representations, and warranties from both parties. Thus, while both documents serve the purpose of facilitating a loan, the Loan Agreement offers a more comprehensive framework for the relationship between the borrower and lender.

The Personal Loan Agreement is another document that bears resemblance to the Montana Promissory Note. This agreement outlines the terms under which an individual borrows money from another individual or institution. Similar to the Promissory Note, it specifies the loan amount, interest rate, and repayment schedule. However, the Personal Loan Agreement may also include terms regarding personal guarantees or co-signers, providing additional security for the lender. The essence of both documents is to establish a clear understanding of the repayment obligations.

Understanding the nuances of various financial agreements is crucial, as each document, such as a promissory note and a student loan agreement, serves to outline specific terms and obligations between parties. To avoid any ambiguities regarding more complex legal documents, such as a Last Will and Testament, resources like TopTemplates.info can provide guidance and clarity, ensuring that individuals can navigate these significant legal frameworks effectively.

Lastly, the Business Loan Agreement aligns closely with the Montana Promissory Note but is tailored specifically for business transactions. This document serves to formalize the terms under which a business borrows funds from a lender. It typically includes details such as the loan amount, interest rate, repayment terms, and any covenants that the business must adhere to during the loan period. Like the Promissory Note, it aims to protect the lender’s interests while ensuring that the borrower understands their obligations, thus fostering a transparent lending relationship.