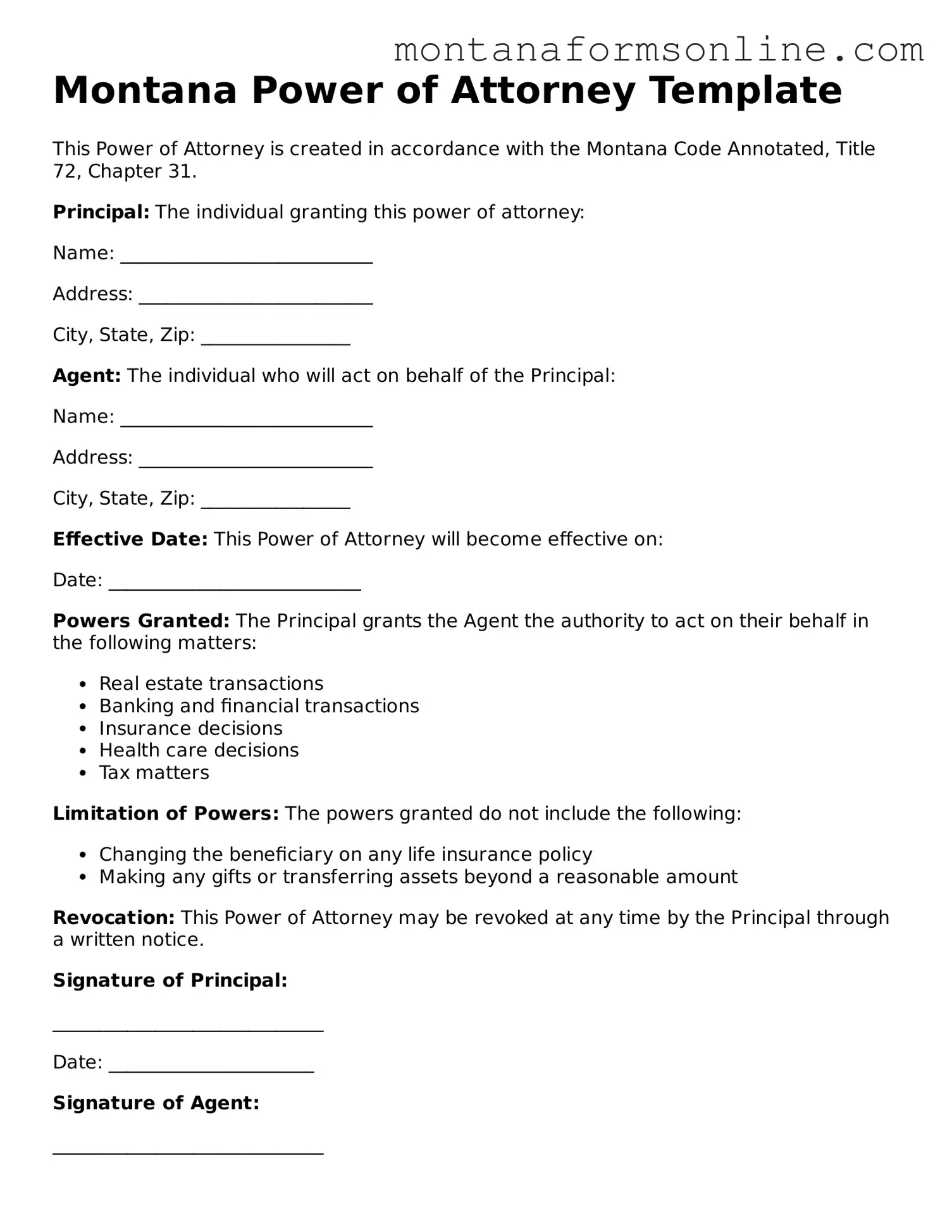

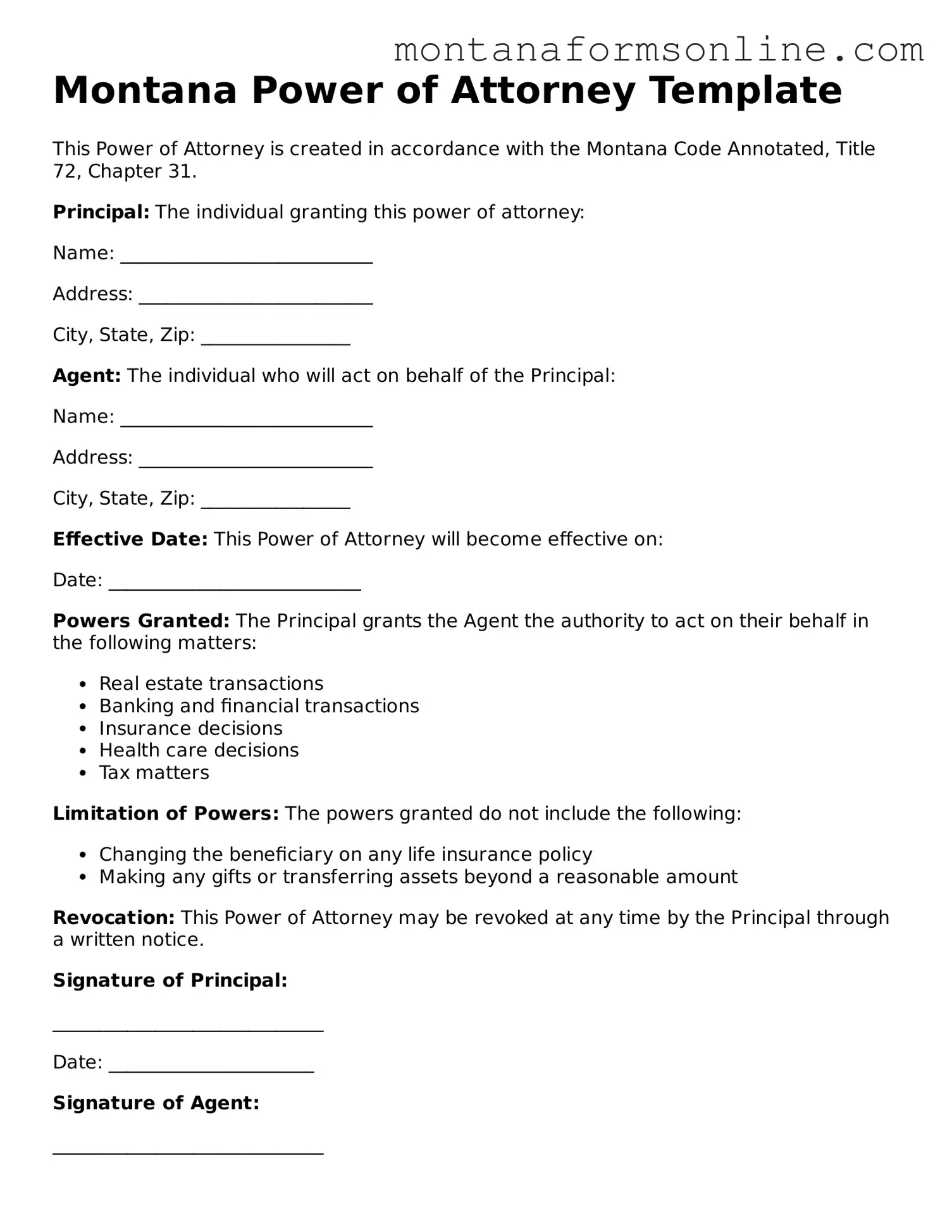

Fillable Montana Power of Attorney Template

A Montana Power of Attorney form is a legal document that allows one person to grant another individual the authority to make decisions on their behalf. This form can cover a wide range of matters, from financial transactions to healthcare decisions, ensuring that your wishes are respected even when you cannot communicate them. Understanding how this document works is crucial for anyone looking to plan for the future or manage their affairs effectively.

Modify Document

Fillable Montana Power of Attorney Template

Modify Document

Modify Document

or

➤ Power of Attorney

Fast completion starts here

Edit, save, and download Power of Attorney online in minutes.