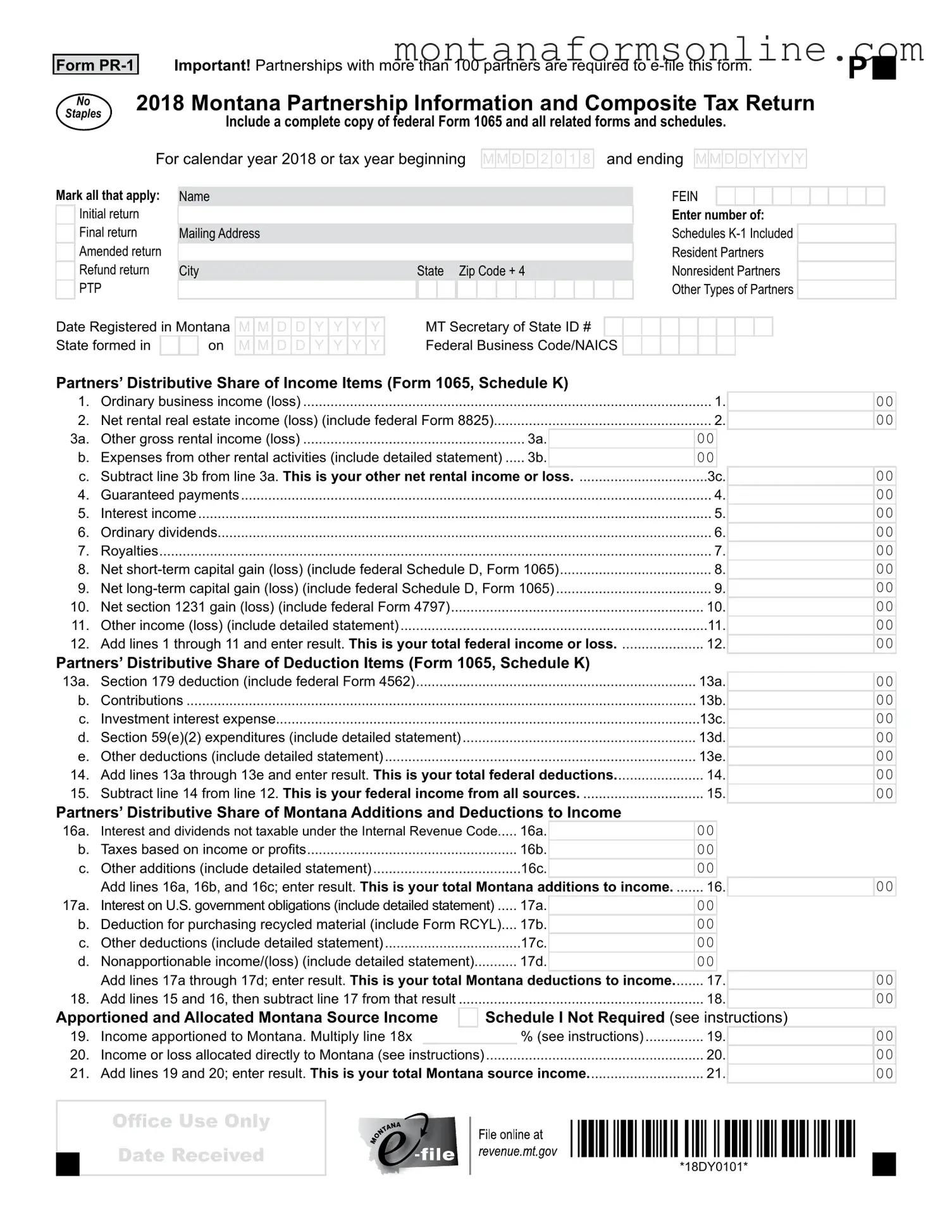

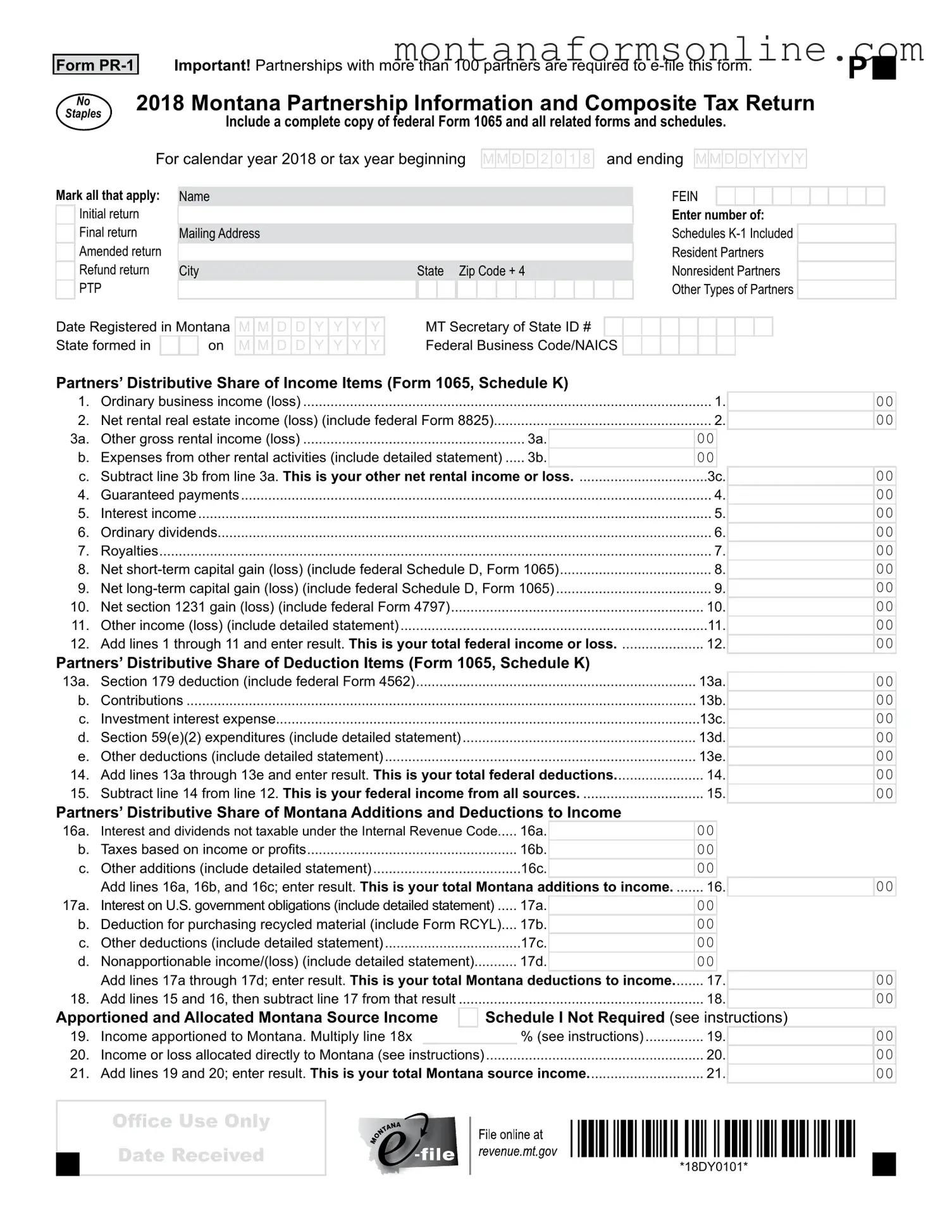

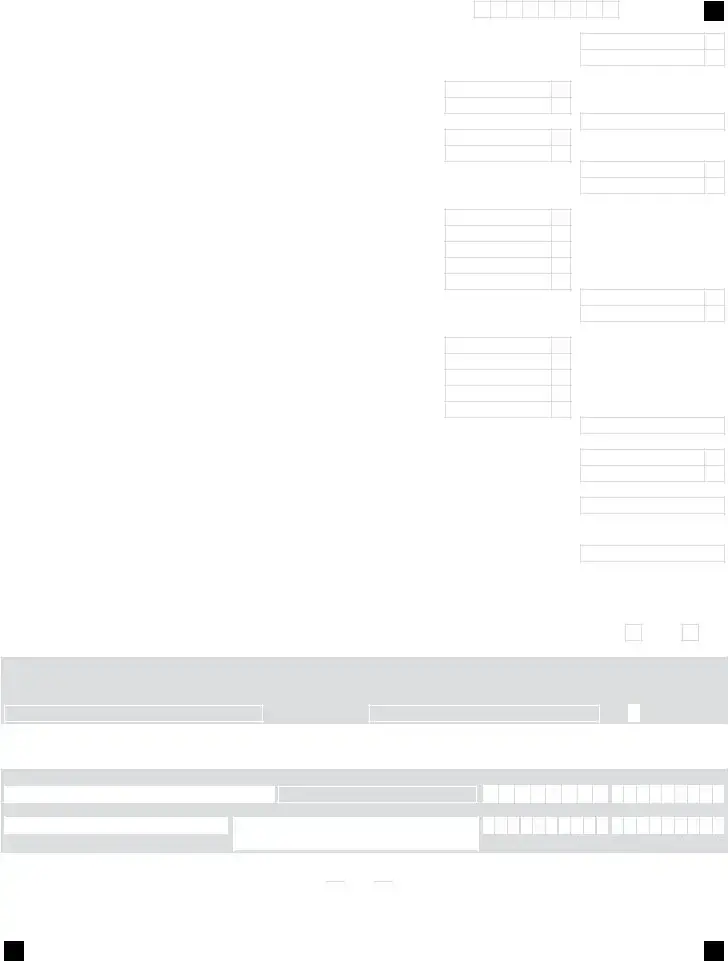

1a. |

.............................................................................................Land |

|

|

00 |

|

|

|

|

|

00 |

|

1b. |

......................................................................................Buildings |

|

|

00 |

|

|

|

|

|

00 |

|

....................................................................................1c. Machinery |

|

|

00 |

|

|

|

|

|

00 |

|

1d. |

Equipment |

1d. |

|

|

00 |

|

|

|

|

|

00 |

|

1e. |

...................................................................Furniture and fixtures |

|

|

00 |

|

|

|

|

|

00 |

|

1f. |

.........................................................Leases and leased property |

|

|

00 |

|

|

|

|

|

00 |

|

1g. |

...................................................................................Inventories |

|

|

00 |

|

|

|

|

|

00 |

|

1h. |

........................................................................Depletable assets |

|

|

00 |

|

|

|

|

|

00 |

|

1i. |

........................................................................Supplies and other |

|

|

00 |

|

|

|

|

|

00 |

|

..................1j. Property of foreign subs included in combined group |

|

|

00 |

|

|

|

|

|

00 |

|

....1k. Property of unconsolidated subs included in combined group |

|

|

00 |

|

|

|

|

|

00 |

|

1l. |

.....Property of pass-through entities included in combined group |

|

|

00 |

|

|

|

|

|

00 |

|

............................1m.Multiply amount of rents by 8 and enter result |

1m. |

|

|

00 |

|

|

|

|

|

00 |

|

....................................Total Property Value add lines 1a through 1m |

|

|

00 |

|

|

|

|

|

00 |

|

Divide the total in column B by the total in column A. Multiply the result |

by 100. This is your |

property |

factor |

1. |

|

|

|

2. Payroll Factor: |

|

|

|

|

|

|

|

|

|

|

|

2a. |

.............................................................Compensation of officers |

|

|

00 |

|

|

|

|

|

00 |

|

2b. |

.....................................................................Salaries and wages |

|

|

00 |

|

|

|

|

|

00 |

|

|

Payroll included in: |

|

|

|

|

|

|

|

|

|

|

|

2c. |

.....................................................................Costs of goods sold |

|

|

00 |

|

|

|

|

|

00 |

|

2d. |

..................................................Other expenses and deductions |

|

|

00 |

|

|

|

|

|

00 |

|

2e. |

....................Payroll of foreign subs included in combined group |

|

|

00 |

|

|

|

|

|

00 |

|

2f. |

........Payroll of unconsolidated subs included in combined group |

|

|

00 |

|

|

|

|

|

00 |

|

2g. |

......Payroll of pass-through entities included in combined group |

|

|

00 |

|

|

|

|

|

00 |

|

........................................Total Payroll Value add lines 2a through 2g |

|

|

00 |

|

|

|

|

|

00 |

|

Divide the total in column B by the total in column A. Multiply the result |

by 100. This is your payroll |

|

factor |

2. |

|

|

|

3. Gross Receipts Factor: |

|

|

|

|

|

|

|

|

|

|

|

3a. |

.............................Gross Receipts, less returns and allowances |

3a. |

|

|

00 |

|

|

|

|

|

|

|

3b. |

Receipts delivered or shipped to Montana purchasers: |

|

|

|

|

|

|

|

|

|

|

|

|

.................................................................................(1) Shipped from outside Montana |

|

3b.(1) |

|

|

00 |

|

|

...................................................................................(2) Shipped from within Montana |

|

3b.(2) |

|

|

00 |

|

3c. Receipts shipped from Montana to: |

|

|

|

|

|

|

|

|

|

|

|

|

........................................................................................(1) United States government |

|

3c.(1) |

|

|

|

|

00 |

|

|

..........................................(2) Purchasers in a state where the taxpayer is not taxable |

|

|

|

|

00 |

|

3d. |

......................Receipts other than receipts of tangible personal property (e.g. service income) |

3d. |

|

|

|

|

00 |

|

3e. |

........Net gains reported on federal Schedule D and Form 4797 |

3e. |

|

|

00 |

|

|

|

|

|

00 |

|

3f. |

....................Other gross receipts (rents, royalties, interest, etc.) |

|

|

00 |

|

|

|

00 |

|

3g. |

................Receipts of foreign subs included in combined group |

3g. |

|

|

00 |

|

|

|

00 |

|

3h. |

...Receipts of unconsolidated subs included in combined group |

3h. |

|

|

00 |

|

|

|

00 |

|

3i. Receipts (pro-rata share) of pass-through entities |

|

|

|

|

|

|

|

|

|

|

|

|

. ................................................included in combined group |

|

|

00 |

|

|

|

|

|

00 |

|

3j. |

............................................Less: All intercompany transactions |

|

|

00 |

|

|

|

|

|

00 |

|

......................................Total Receipts Value add lines 3a through 3j |

|

|

00 |

|

|

|

|

|

00 |

|

Divide the total in column B by the total in column A. Multiply the result |

by 100. This is your receipts |

factor |

3. |

|

|

|

|

.................................................4. Add the percentages on lines 1, 2, and 3 in column C. This is the sum of your factors |

|

|

|

4. |

|

|

|

|

M

M D

D D

D 2 0

2 0  1 8

1 8 D D

D D Y

Y Y

Y Y

Y Y

Y 00

00

*18DY0101*

*18DY0101*

00

00 00

00 00

00 00

00 Yes

Yes

No

No