The Montana NR-1 form shares similarities with the W-2 form, which is a crucial document for employees in the United States. The W-2 form reports an employee's annual wages and the taxes withheld from their paycheck. Like the NR-1, the W-2 provides information that is essential for filing income tax returns. Both forms require the disclosure of income earned, and they help ensure that individuals report their earnings accurately to the tax authorities. While the W-2 is specific to employment income, the NR-1 focuses on income exempt from Montana taxes due to a reciprocal agreement with North Dakota.

Understanding the intricacies of various tax forms, such as the Montana NR-1, can significantly aid taxpayers in navigating the complexities of state income taxation. It's essential for individuals earning income across state lines to be well-informed about the documentation process. Resources like TopTemplates.info can provide valuable guidance on understanding specific forms and their requirements, ensuring that taxpayers fulfill their obligations while minimizing any potential tax liabilities.

Another document that resembles the NR-1 is the 1099 form, which is used to report various types of income other than wages, salaries, and tips. For freelancers and independent contractors, the 1099 form is vital for declaring income received from clients. Similar to the NR-1, the 1099 requires the recipient to report income that may be subject to taxation. Both forms emphasize the importance of accurate income reporting and play a role in determining tax obligations, particularly for individuals who may qualify for exemptions or deductions.

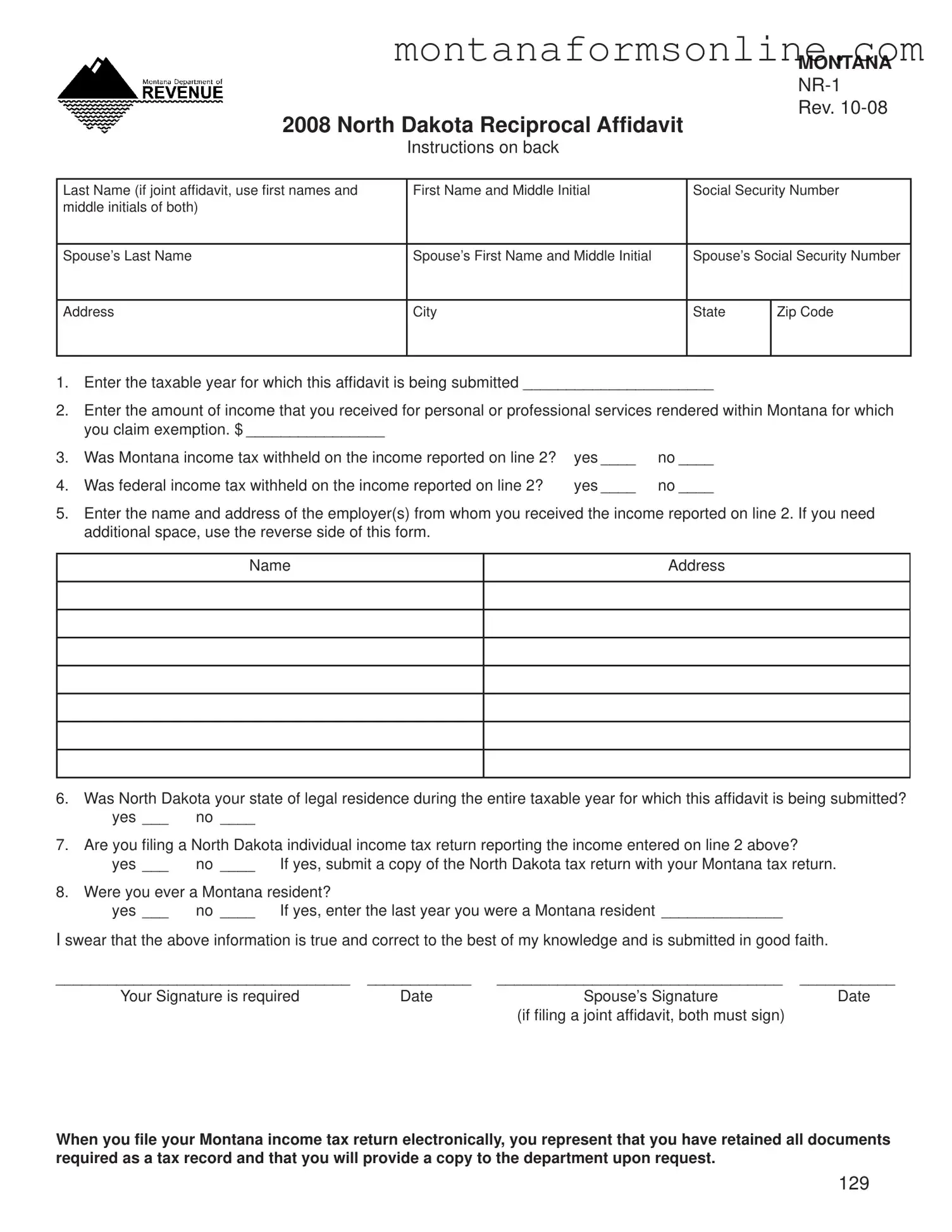

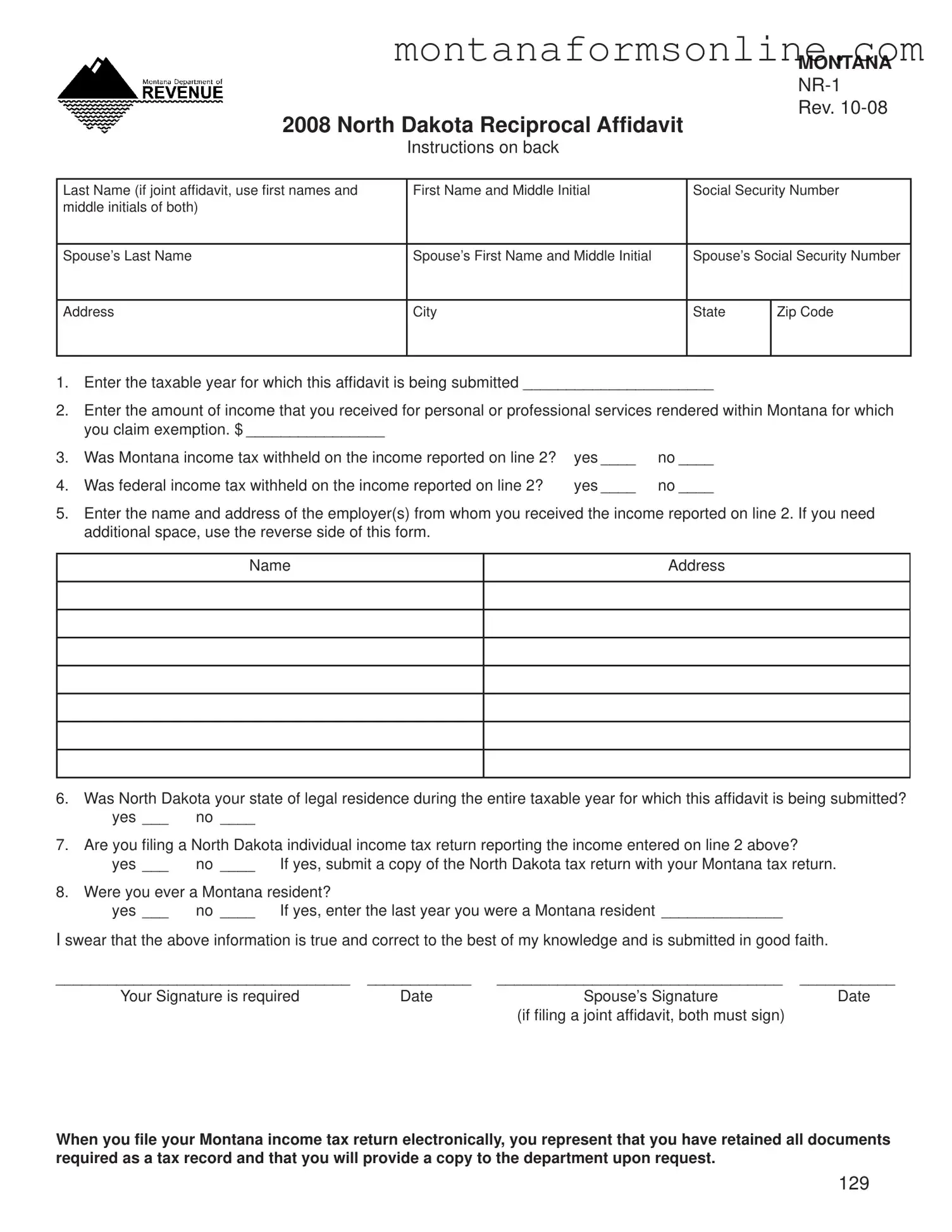

The Montana NR-1 form is also akin to the state tax return forms, such as Montana Form 2, which is used to report individual income tax. When individuals file their state tax returns, they often need to include additional forms like the NR-1 to claim exemptions or credits. Both the NR-1 and state tax return forms require detailed information about income sources, residency status, and tax withholdings. This connection helps to streamline the filing process and ensures that taxpayers are compliant with state tax laws.

In addition, the NR-1 is similar to the federal Form 1040, which is the standard individual income tax return form used in the United States. Both forms require individuals to report their income and provide information about deductions and exemptions. The NR-1, while specific to Montana and North Dakota residents, serves a similar purpose in determining tax liability. The 1040 is a broader federal document, but both forms underscore the necessity of accurate reporting and compliance with tax regulations.

Lastly, the NR-1 form can be compared to the Employee's Certificate of North Dakota Residence (Form NR-2). This document is used by individuals to certify their residency in North Dakota to their employers, thereby preventing unnecessary withholding of Montana income tax. Both forms are designed to facilitate the tax exemption process for North Dakota residents working in Montana. They work together to ensure that individuals are not taxed by both states on the same income, promoting fairness and clarity in tax obligations.