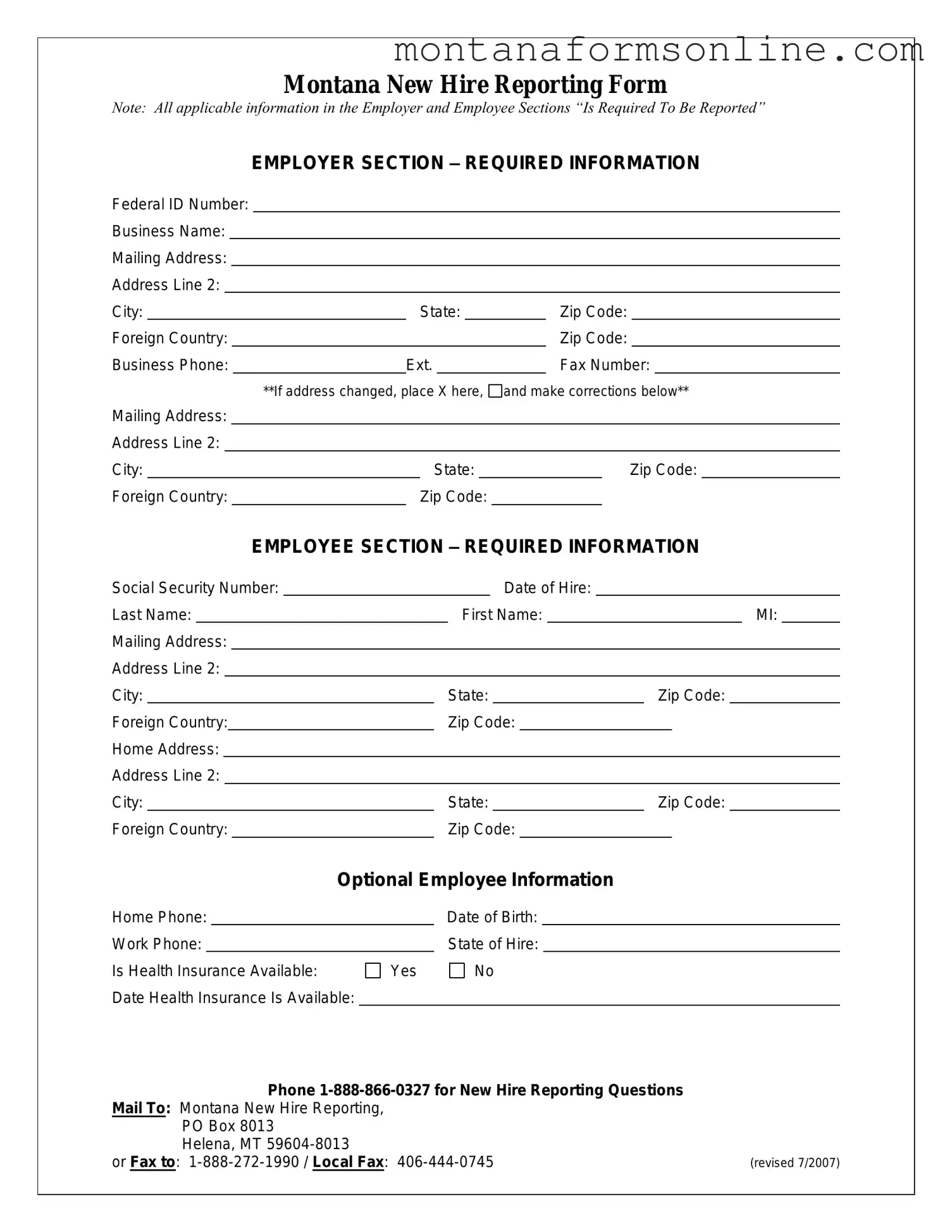

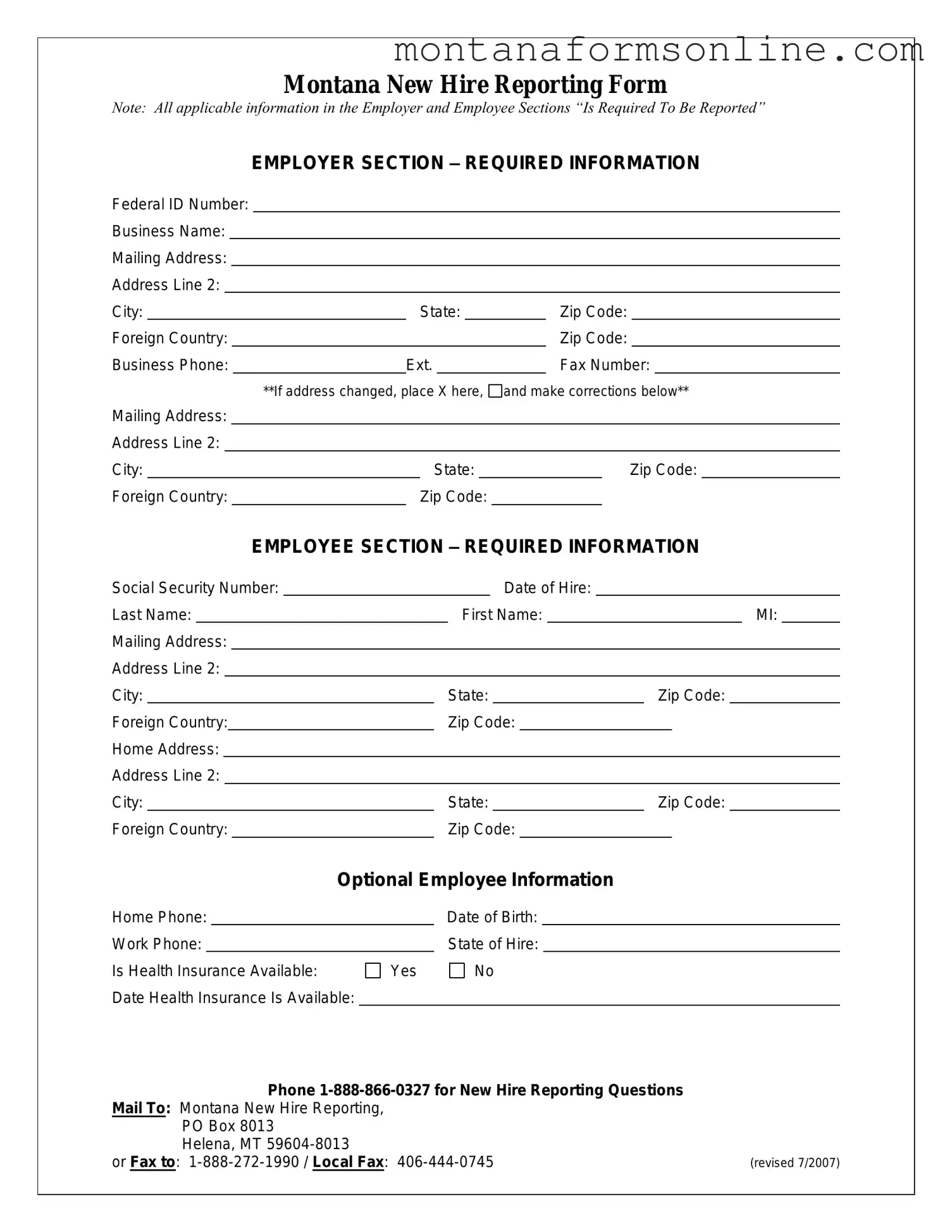

The Montana New Hire Reporting Form is similar to the Federal W-4 Form, which employees fill out to determine their tax withholding. Both documents require personal information, such as the employee's name, address, and Social Security Number. The W-4 specifically helps employers calculate the correct amount of federal income tax to withhold from an employee’s paycheck. Like the Montana New Hire form, the W-4 is essential for ensuring compliance with tax regulations and is often submitted shortly after an employee is hired.

When navigating the intricacies of rental agreements, it is important for both landlords and tenants to rely on comprehensive resources. A Lease Agreement form plays a vital role in defining the terms of a rental, such as length of stay and payment obligations. For those seeking to understand or draft a solid lease, valuable templates can be found at TopTemplates.info, ensuring clarity and protection for all parties involved.

Another document akin to the Montana New Hire Reporting Form is the I-9 Employment Eligibility Verification form. This form is used to verify an employee's identity and eligibility to work in the United States. Both forms require the collection of sensitive personal information, including the employee's name and Social Security Number. The I-9 must be completed within three days of hiring, much like the timely submission of the Montana New Hire form, highlighting the importance of compliance with federal and state employment laws.

The Employee Information Form, often used by companies to gather additional details about new hires, shares similarities with the Montana New Hire Reporting Form. This document typically collects information such as the employee's contact details and emergency contacts. Both forms serve to ensure that employers have the necessary information to manage their workforce effectively. Moreover, they help facilitate communication between the employer and employee, establishing a foundation for the employment relationship.

Lastly, the State Unemployment Insurance (UI) Registration form bears resemblance to the Montana New Hire Reporting Form. This document is essential for employers to report new employees to the state for unemployment insurance purposes. Similar to the New Hire form, it requires basic information about the employer and employee, including names, addresses, and identification numbers. Both forms play a crucial role in maintaining compliance with state regulations and ensuring that employees have access to unemployment benefits if needed.