The Montana Department of Transportation (MDT) Fuel Refund Application, known as the MDT MF 93 form, shares similarities with several other refund and tax-related documents. One such document is the IRS Form 8849, which is used to claim a refund of certain fuel taxes. Like the MDT MF 93, Form 8849 requires detailed information about the fuel purchased, the tax paid, and the purpose for which the fuel was used. Both forms necessitate the inclusion of original invoices to substantiate the claims, ensuring that applicants provide valid proof of their transactions.

Another similar document is the State of California's Fuel Tax Refund Claim form. This form allows taxpayers to request refunds for fuel taxes paid on fuel used for specific purposes, including agricultural and off-highway use. Much like the MDT MF 93, it requires applicants to detail their fuel purchases, provide invoices, and affirm that the claim is legitimate. Both forms emphasize the importance of maintaining accurate records in case of audits or further inquiries.

The IRS Form 720 is also comparable, as it serves as a quarterly federal excise tax return for various types of fuel, including diesel. While this form is more comprehensive and covers a wider range of taxes, it shares the need for accurate reporting of fuel purchases and tax amounts. Similar to the MDT MF 93, it requires supporting documentation to validate claims and ensure compliance with tax regulations.

In the context of navigating complex tax refund processes, the EDD DE 2501 form is another important document that individuals may need to understand. Just as various forms require detailed personal information and supporting documentation, the EDD DE 2501, known as the Claim for Disability Insurance (DI) Benefits, is essential for workers to secure temporary financial assistance during periods of disability. For comprehensive resources and guidance on this form, visit OnlineLawDocs.com, where users can find valuable information on the submission process and requirements.

The New York State Fuel Tax Refund Application is another document that aligns closely with the MDT MF 93. This application allows businesses to claim refunds on fuel taxes for specific uses, such as heating or agricultural purposes. Both forms require detailed information about fuel purchases and the associated taxes, along with original invoices to support the refund request.

The Texas Diesel Fuel Tax Refund Application is similar in its intent and structure. It allows taxpayers to recover taxes paid on diesel fuel used for qualified activities. Like the MDT MF 93, it mandates the submission of original invoices and a declaration of the fuel’s intended use. Both forms are designed to ensure that only eligible claims are processed, reinforcing the importance of proper documentation.

The Michigan Fuel Tax Refund Application also bears resemblance to the MDT MF 93. This form permits taxpayers to request refunds for fuel taxes paid on fuel used for specific exempt purposes. Both forms require applicants to provide detailed information about their fuel purchases, including dates and amounts, as well as original invoices to substantiate their claims.

The Florida Fuel Tax Refund Application is another document that aligns with the MDT MF 93. This application allows eligible entities to claim refunds on fuel taxes paid for specific uses. Both forms emphasize the need for accurate record-keeping and the submission of original invoices, ensuring that applicants can substantiate their claims effectively.

The Pennsylvania Fuel Tax Refund Application is similar as well, allowing individuals and businesses to recover taxes paid on fuel used for exempt purposes. Just like the MDT MF 93, it requires detailed reporting of fuel purchases and mandates the inclusion of original invoices to support refund requests.

Lastly, the Illinois Motor Fuel Tax Refund Application shares commonalities with the MDT MF 93. This form enables taxpayers to claim refunds for motor fuel taxes paid on fuel used for specific purposes, such as agricultural use. Both forms require comprehensive details about fuel purchases and supporting documentation, reinforcing the importance of accurate record-keeping in the refund process.

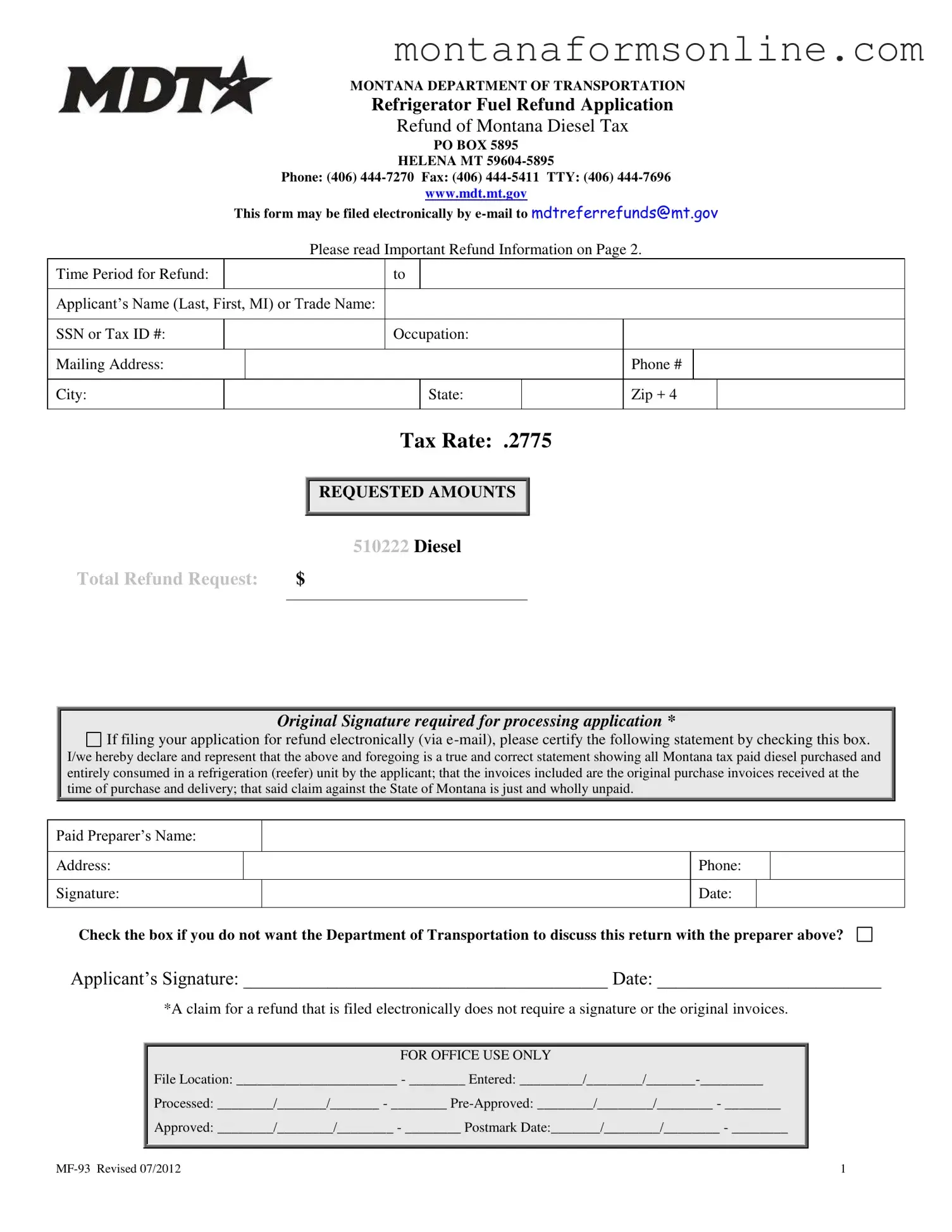

REQUESTED AMOUNTS

REQUESTED AMOUNTS

TOTAL REFUND AMOUNT (Total gallons multiplied by tax rate of $.2775)

TOTAL REFUND AMOUNT (Total gallons multiplied by tax rate of $.2775)