What is a Last Will and Testament?

A Last Will and Testament is a legal document that outlines how a person's assets and affairs should be handled after their death. It specifies who will inherit property, appoints guardians for minor children, and can even designate an executor to manage the estate. This document ensures that a person's wishes are respected and followed after they pass away.

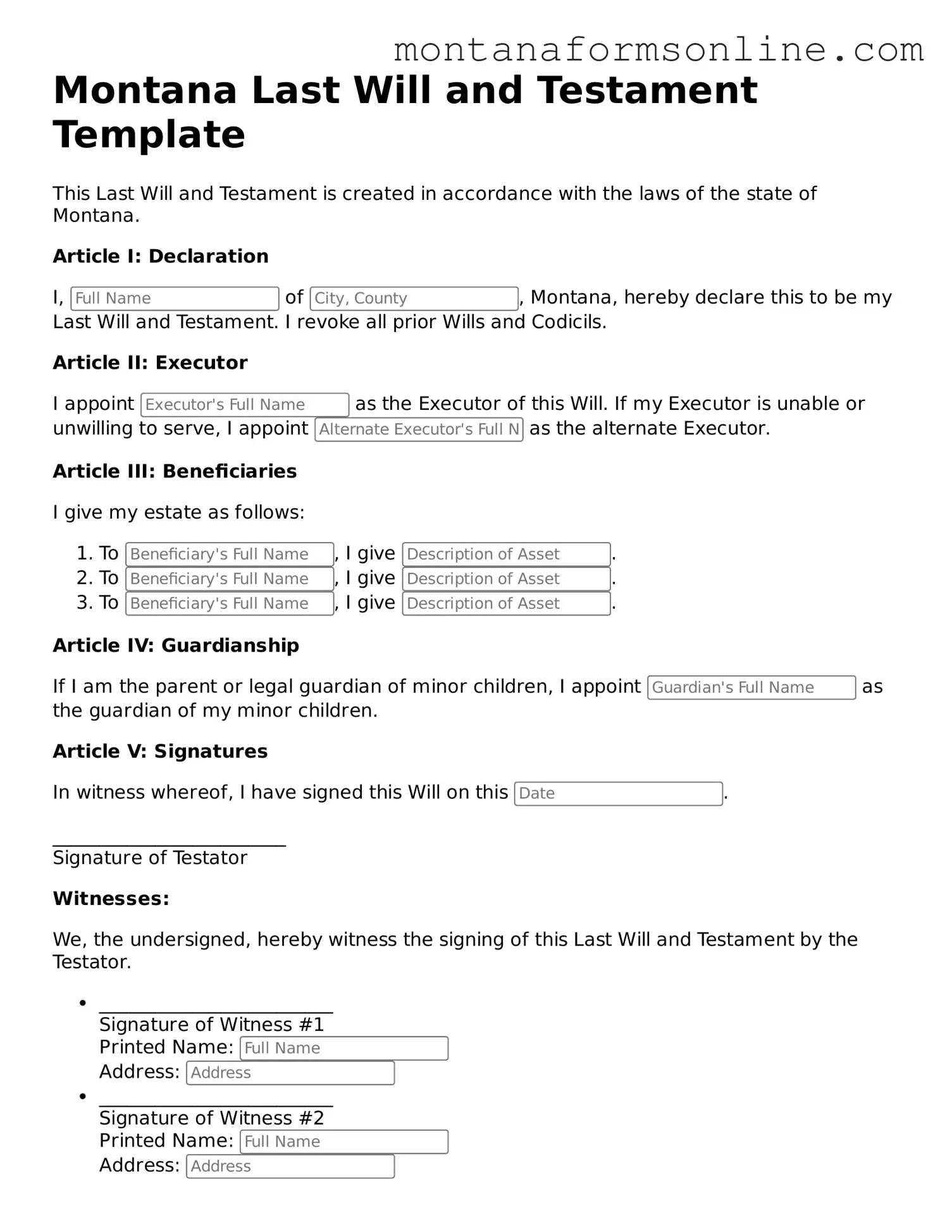

Do I need a lawyer to create a Last Will and Testament in Montana?

While it is not mandatory to hire a lawyer to create a Last Will and Testament in Montana, consulting with a legal professional can be beneficial. A lawyer can help ensure that the will meets all legal requirements and accurately reflects your wishes. However, individuals can also use templates or forms available online to draft their own wills if they feel confident in doing so.

What are the legal requirements for a Last Will and Testament in Montana?

In Montana, a valid Last Will and Testament must meet the following criteria:

-

The testator (the person creating the will) must be at least 18 years old.

-

The will must be in writing.

-

The testator must sign the will, or someone else may sign it in their presence and at their direction.

-

The will must be witnessed by at least two individuals who are not beneficiaries of the will.

Can I change my Last Will and Testament after it is created?

Yes, you can change your Last Will and Testament at any time as long as you are mentally competent. Changes can be made by creating a new will or by drafting a codicil, which is an amendment to the existing will. It is important to follow the same legal formalities when making changes to ensure that the new document is valid.

What happens if I die without a will in Montana?

If a person dies without a will, they are said to have died "intestate." In this case, Montana's intestacy laws will determine how the deceased's assets are distributed. Typically, assets will be divided among surviving relatives, such as spouses, children, and parents, according to a specific hierarchy established by state law. This process may not align with the deceased's wishes, highlighting the importance of having a will.

Can I disinherit someone in my Last Will and Testament?

Yes, you can disinherit an individual in your Last Will and Testament. However, it is advisable to explicitly state your intentions to avoid any confusion or legal disputes after your death. By clearly outlining your wishes, you can minimize the chances of a contested will.

What is an executor, and how do I choose one?

An executor is the person responsible for managing the deceased's estate according to the terms of the will. This includes settling debts, distributing assets, and ensuring that the will is executed properly. When choosing an executor, consider someone who is organized, trustworthy, and capable of handling financial matters. It can be a family member, friend, or even a professional, such as an attorney or financial advisor.

How can I ensure my Last Will and Testament is valid?

To ensure that your Last Will and Testament is valid, follow these steps:

-

Make sure you are of sound mind and at least 18 years old when creating the will.

-

Sign the will in the presence of at least two witnesses who are not beneficiaries.

-

Store the will in a safe place and inform your executor of its location.

-

Review and update your will periodically, especially after major life events.

Is a handwritten will valid in Montana?

Yes, a handwritten will, also known as a holographic will, can be valid in Montana if it meets certain criteria. The will must be signed by the testator, and the material provisions must be in the testator's handwriting. However, it is advisable to follow formal procedures to avoid potential disputes and ensure that the will is recognized by the court.

What should I do with my Last Will and Testament after it's created?

After creating your Last Will and Testament, take the following steps:

-

Store it in a secure location, such as a safe or with your attorney.

-

Inform your executor and trusted family members about its location.

-

Review the will periodically and update it as necessary, especially after significant life changes.