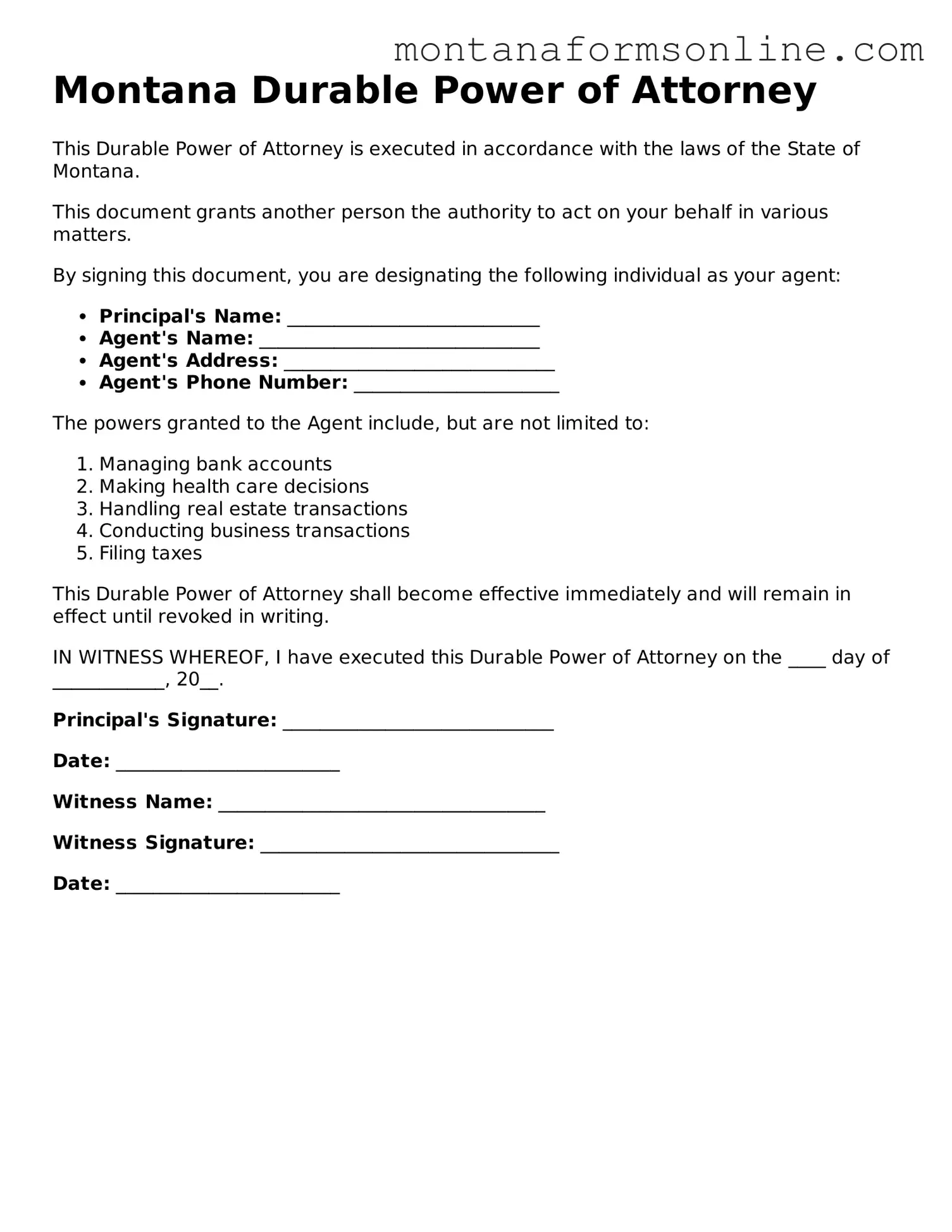

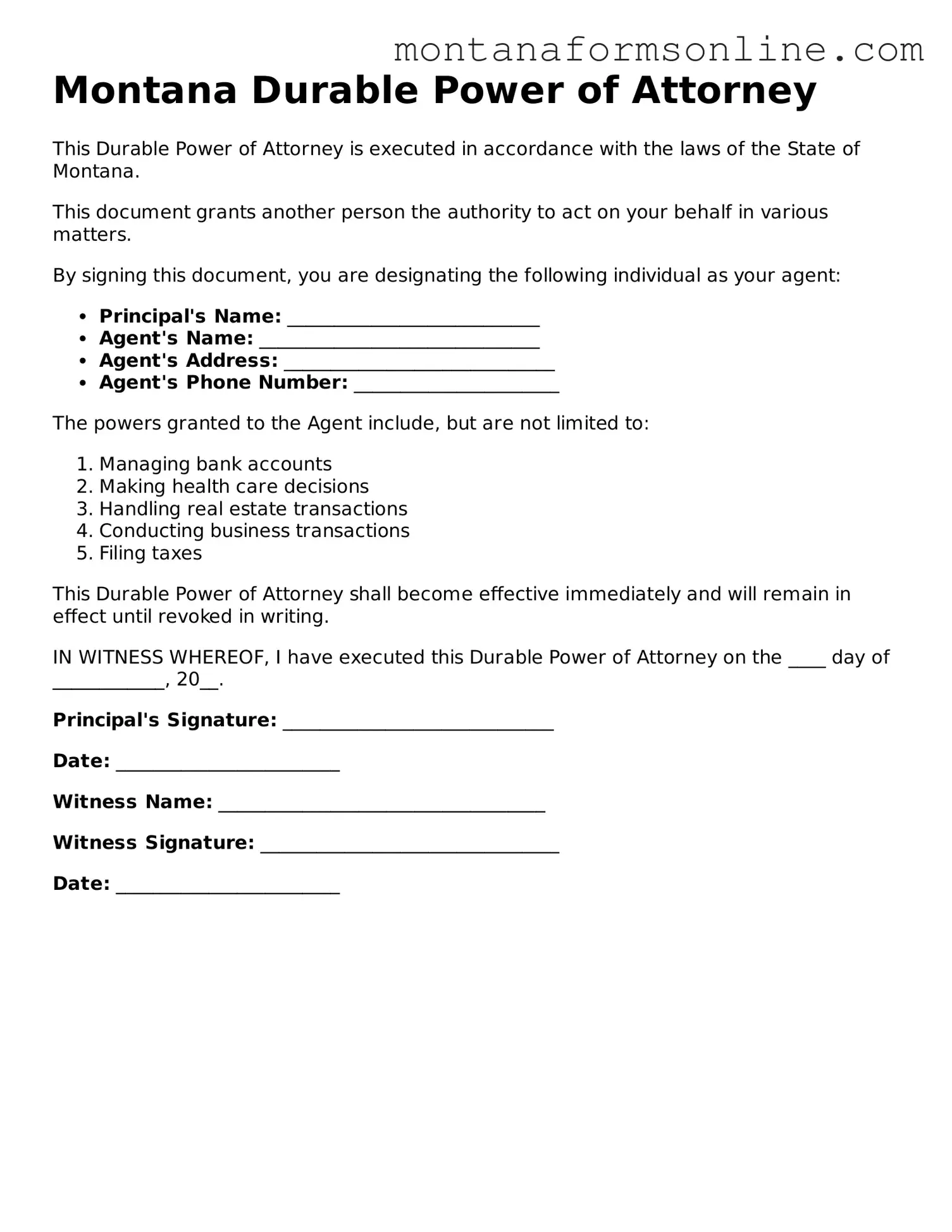

The Montana Durable Power of Attorney (DPOA) form shares similarities with the General Power of Attorney. Both documents allow individuals to appoint someone else to make decisions on their behalf. However, the DPOA remains effective even if the principal becomes incapacitated, while the General Power of Attorney typically ceases to be valid under such circumstances. This key distinction makes the DPOA particularly useful for long-term planning.

Another document akin to the DPOA is the Healthcare Power of Attorney. This form specifically designates an individual to make medical decisions for someone who is unable to do so. Like the DPOA, the Healthcare Power of Attorney is effective during periods of incapacity. Both documents empower agents to act in the best interest of the principal, but the Healthcare Power of Attorney focuses solely on health-related matters.

For those pursuing a nursing career in Arizona, it is essential to familiarize yourself with the required documentation, such as the Arizona Board Of Nursing License form, which outlines the licensing process and necessary qualifications to ensure compliance with state regulations.

The Living Will is also comparable to the DPOA, as it addresses decisions regarding end-of-life care. While the DPOA allows for broader financial and legal decisions, the Living Will specifically outlines an individual’s wishes regarding medical treatment in terminal situations. Together, these documents provide comprehensive guidance for healthcare and financial matters.

A Revocable Trust shares similarities with the DPOA in that both allow for the management of assets. A Revocable Trust can hold property and assets, providing a means for managing them during the grantor’s lifetime and distributing them after death. Unlike the DPOA, which grants authority to an agent, a Revocable Trust allows the grantor to maintain control until they decide otherwise.

The Financial Power of Attorney is another document that resembles the DPOA. It grants authority to an agent to handle financial matters, such as banking and investments. However, the Financial Power of Attorney may not always remain effective during the principal’s incapacity, depending on the specific terms outlined in the document. The DPOA, on the other hand, is designed to remain valid even in such situations.

The Special Power of Attorney is similar to the DPOA but is limited to specific tasks or transactions. This document allows the principal to authorize an agent to act on their behalf for particular matters, such as selling a property or managing a business. Unlike the DPOA, which provides broad powers, the Special Power of Attorney is more narrowly focused and often used for single transactions.

The Advance Healthcare Directive combines elements of both the Healthcare Power of Attorney and the Living Will. It allows individuals to express their healthcare preferences and appoint an agent for medical decisions. Like the DPOA, it serves to ensure that the principal’s wishes are respected, particularly when they cannot communicate their desires directly.

The Guardianship document, while different in purpose, relates to the DPOA in that it involves decision-making for individuals who cannot care for themselves. A court appoints a guardian to manage personal and financial affairs for someone deemed incapacitated. In contrast, a DPOA allows individuals to choose their agents without court intervention, making it a more proactive approach to future incapacity.

The Medical Power of Attorney is another document that functions similarly to the DPOA by allowing someone to make healthcare decisions on behalf of another. While the DPOA can cover a wide range of decisions, the Medical Power of Attorney is specifically tailored for health-related issues. Both documents ensure that the principal’s preferences are honored, but they serve distinct purposes within the realm of decision-making.

Finally, the Durable Power of Attorney for Finances is closely related to the DPOA. Both documents grant authority to an agent to manage financial affairs. The key difference lies in the emphasis: the Durable Power of Attorney for Finances focuses solely on financial matters, while the DPOA may encompass a broader range of legal and financial responsibilities. This makes the DPOA a versatile tool for comprehensive planning.