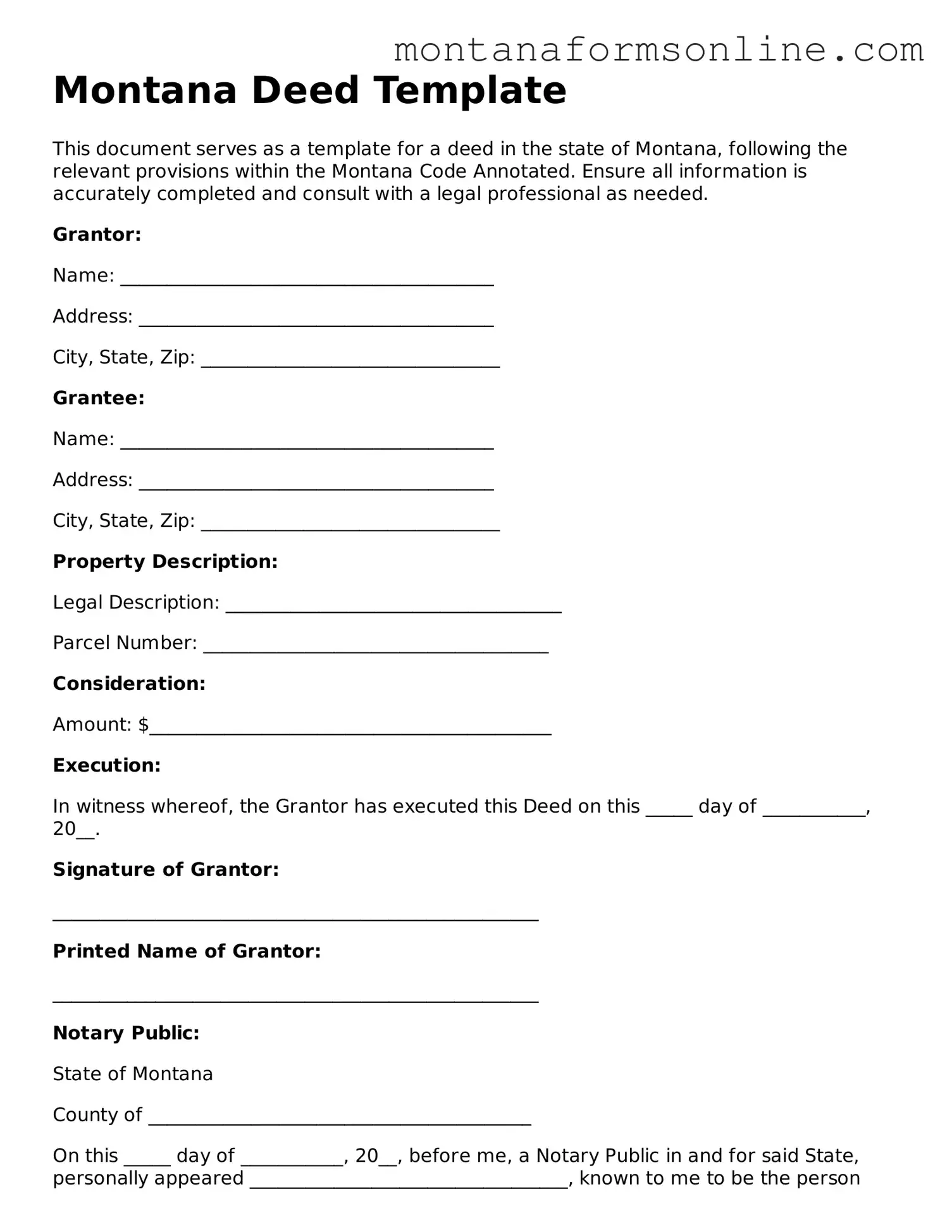

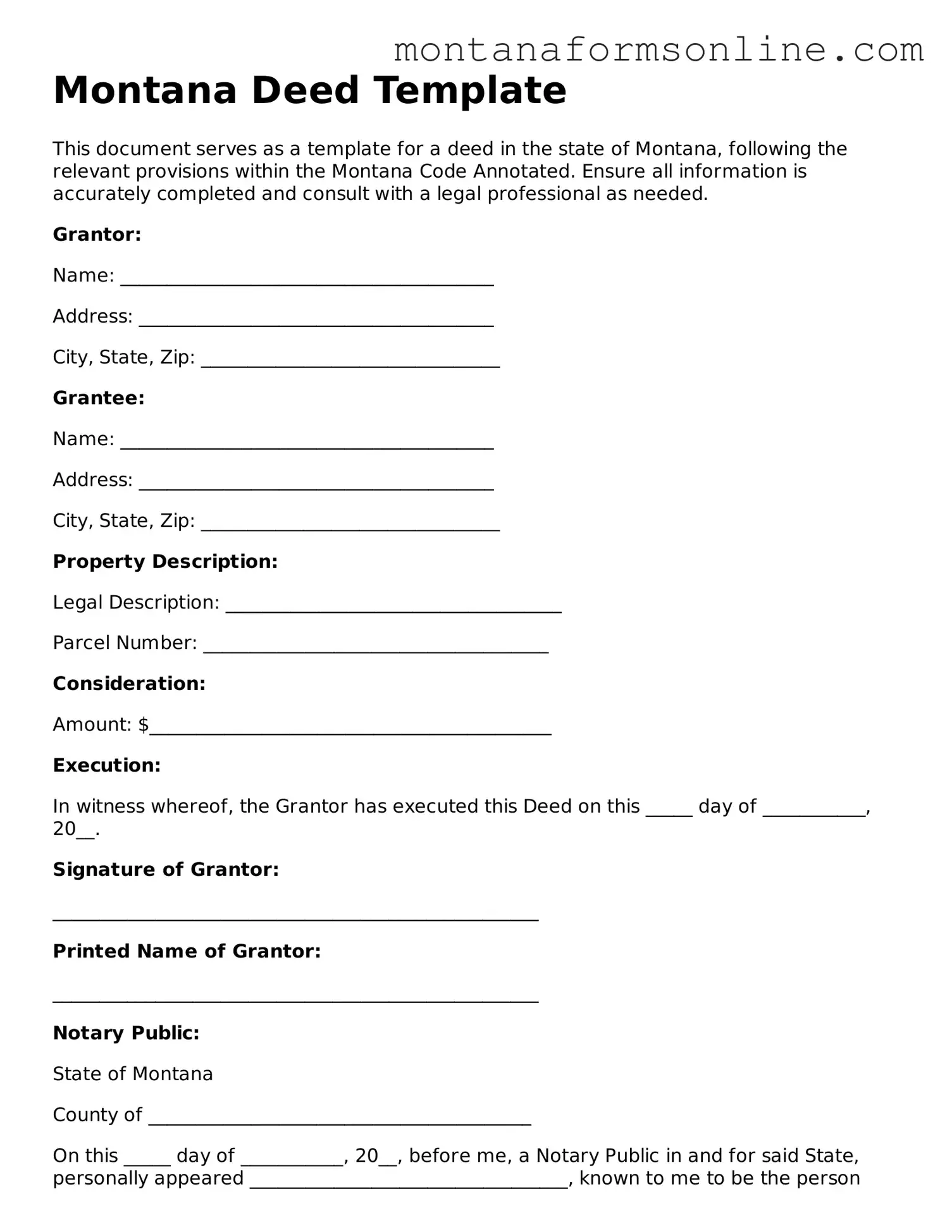

Fillable Montana Deed Template

The Montana Deed form is a legal document used to transfer property ownership in the state of Montana. This form outlines the details of the transaction, ensuring that both the seller and buyer understand their rights and responsibilities. Utilizing this deed is essential for a smooth and legally binding transfer of real estate.

Modify Document

Fillable Montana Deed Template

Modify Document

Modify Document

or

➤ Deed

Fast completion starts here

Edit, save, and download Deed online in minutes.