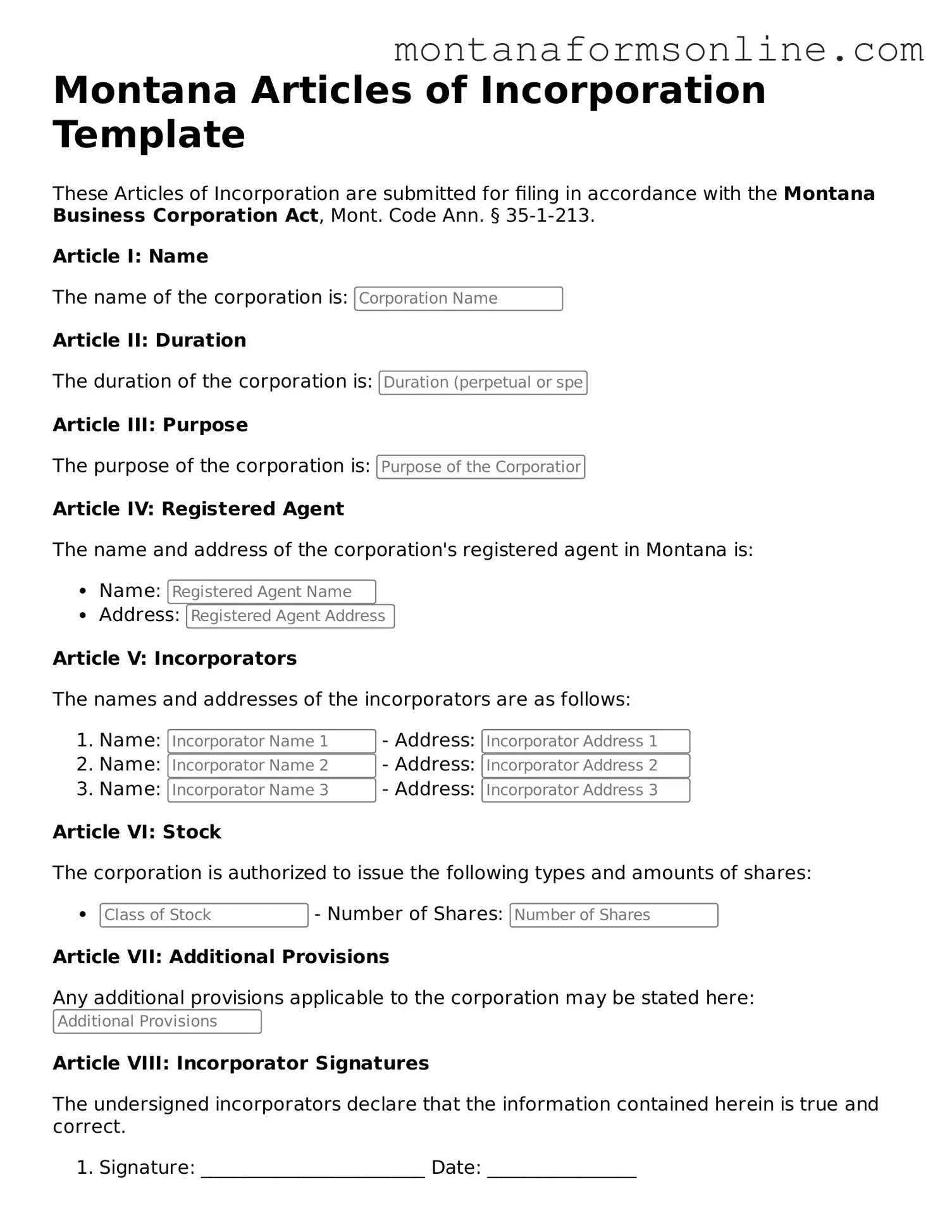

The Articles of Incorporation is similar to the Certificate of Formation, which is used in several states to officially establish a business entity. Both documents serve the purpose of creating a legal entity recognized by the state. They typically require basic information such as the business name, registered agent, and the purpose of the business. While the terminology may vary from state to state, the underlying function remains the same: to provide a framework for the operation of a business.

In the realm of business documentation, it is also important to understand the role of lease agreements, particularly in California. A California Lease Agreement form is a legally binding document used between a landlord and a tenant to outline the terms and conditions of renting a property in California. This form covers various aspects including rent payments, security deposits, and the rights and duties of both parties. Crafting a comprehensive lease agreement is crucial for ensuring a clear understanding and avoiding future disputes, as noted on TopTemplates.info.

Another comparable document is the Bylaws of a corporation. While the Articles of Incorporation lay the groundwork for the corporation's existence, the Bylaws outline the internal rules and procedures for governance. They detail how meetings are conducted, how directors are elected, and the roles of officers. Together, these documents ensure that a corporation operates smoothly and in accordance with both state laws and its own established guidelines.

The Operating Agreement serves a similar purpose for Limited Liability Companies (LLCs). Like the Articles of Incorporation, the Operating Agreement is foundational for the entity's structure. It specifies the management structure, ownership percentages, and operational procedures. This document is crucial for ensuring that all members understand their rights and responsibilities, thereby reducing potential conflicts.

The Partnership Agreement is another document that shares similarities with the Articles of Incorporation. This agreement outlines the terms and conditions under which a partnership operates. It typically includes details about profit sharing, decision-making processes, and the roles of each partner. Just as Articles of Incorporation formalize a corporation's existence, a Partnership Agreement formalizes the relationship between partners.

The Statement of Information is also akin to the Articles of Incorporation. This document is often required shortly after incorporation and provides updated information about the corporation's management and address. It serves as a means for the state to keep accurate records of business entities, ensuring that contact information and corporate structure are current and accessible.

The Certificate of Good Standing is another document that relates to the Articles of Incorporation. This certificate confirms that a corporation is legally registered and complies with state regulations. While the Articles of Incorporation initiate the formation of a business, the Certificate of Good Standing serves as proof of its ongoing compliance, which can be essential for securing loans or entering contracts.

Lastly, the Business License is similar in that it is often required to legally operate a business. While the Articles of Incorporation establish the entity's legal status, a Business License permits the entity to engage in specific activities within a jurisdiction. Both documents are essential for compliance with local, state, and federal regulations, ensuring that the business operates within the law.